Clean, preferably emission-free, multiple-unit trains are the backbone of environmentally friendly passenger rail transportation. This makes it even more urgent to remove old diesel trains from the fleet and replace them with energy-efficient electric vehicles. While the first operations have been launched with alternatively driven trains in Europe, other countries have chosen to electrify their respective networks.

Keeping a rapid pace, Asian countries are pursuing the ambitious goal of expanding regional and suburban transport and operating these services purely electrical. Significantly higher growth rates concerning deliveries of electric multiple units could be observed in India and China. In Europe, the overall market presents itself with a stable and resistant image after the challenging coronavirus years; however, it is still behind expectations, especially when decarbonising the fleets. These are the results of the most recent market study, “Multiple Units – Global Market Trends”, available from September 2024.

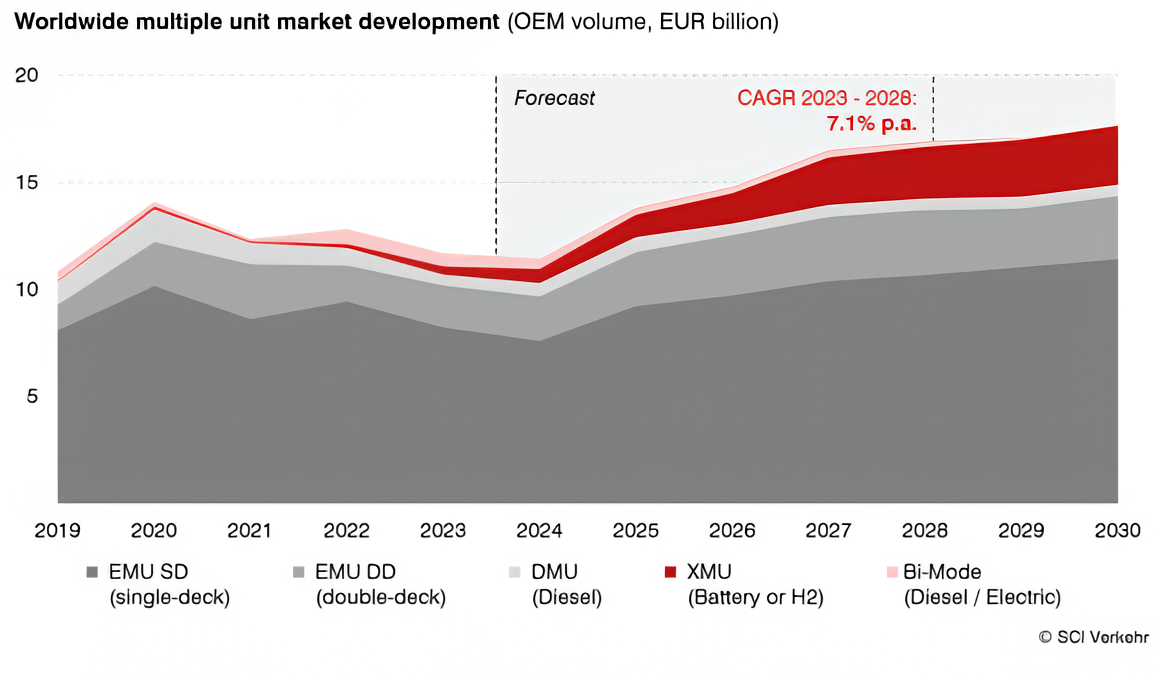

Despite the ongoing insecurities in the global economy, the market for multiple-unit trains in regional and suburban transport will grow substantially in the coming years. With an annual growth rate of 7.1%, the demand for new vehicles will presumably exceed EUR 16 billion in 2028 (OEM, without after-sales). The current OEM level of around EUR 12 billion for new vehicles is largely determined by single-deck regional and commuter trains, which comprise about 70% of the total volume. In the future, double-deck vehicles and alternatively driven multiple units (XMU) will have a significant share. In Europe, suburban trains are an essential driver – in many Central European countries, fleet replacements or capacity increases are pending in the near future.

Batteries are ahead of hydrogen – XMUs as growth accelerator

The global ambitions for the decarbonisation of the railways are being accelerated with the emergence of XMUs. The replacement of diesel multiple units with XMUs has just started in several countries, albeit more slowly than expected and desired – numerous opening challenges on a technical, operational and financial level are (still) defining the situation. Europe is a forerunner in the development and market introduction of XMUs with battery or hydrogen drive. First operation launches have already been realised in Germany, and many European countries will follow in the coming years. Outside of Europe, especially the US, several orders are active. East Asian countries are eager to replace the partly large fleets of diesel trains (e.g. Japan) in an environmentally friendly way with their own development and production activities.

Battery-powered trains (BEMU) will largely replace diesel trains in the coming decades – hydrogen-powered multiple units (HMU) are in a tough spot. However, as recent orders have shown, HMUs can also be the preferred solution under certain conditions. Nevertheless, funding programmes are mandatory to implement HMU operations in an economically reasonable way because of the more expensive procurement and energy costs compared to BEMUs. Due to a lower level of complexity, BEMUs prove themselves advantageous but can often not get on without additional infrastructure measures, e.g. the construction of overhead sections or charging stations.

Alstom with leading market position – CRRC is catching up due to strong domestic business

The global market for multiple units has overcome numerous hurdles in recent years and is currently emerging stronger from global crises. The prospects for the vehicle industry are especially positive, with well-filled order books. However, these are also applying pressure on the industry, which still has to face challenges related to price increases, staff shortages, and limited availability of resources.

Alstom has strengthened its market share due to its new alignment after the acquisition of Bombardier and is in the lead based on deliveries during the past five years. In China, a major series production of regional trains has made state-owned conglomerate CRRC the number two in worldwide deliveries of electric multiple units. The European competition is well-positioned: Stadler has strongly made up ground with over 200 delivered multiple-unit trains per year and a high market presence from a geographic and product-specific perspective. In the coming years, the Swiss manufacturer will have to assert itself in intensive competition with Siemens and CAF, both with increasing market shares worldwide. All relevant players launched new vehicle concepts in the various segments over suburban trains to XMUs; They are challenging industry leader Alstom, confronted with inherited liabilities, debt repayment and job cuts.

The study “Multiple Units—Global Market Trends 2024” is now available in the SCI online shop. An Excel file provides a clear and transparent presentation of all the figures.

On September 16th, 2024, at 10:30 a.m. (CET), we will offer a free webinar on the study for interested parties. Our project manager will detail the study’s contents and results. You can register here. The webinar will be held in English and will last about 30 minutes.